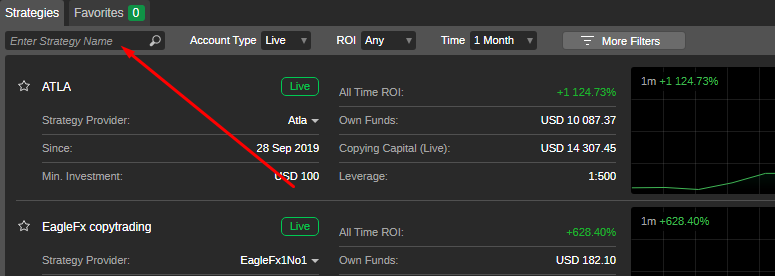

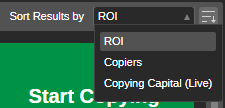

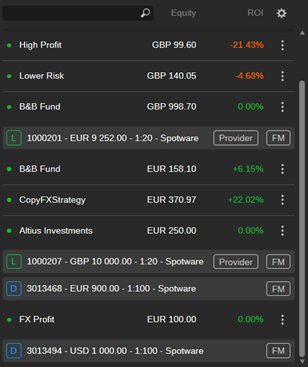

The most difficult and important task for a trader who uses trading signals is the right choice of their provider. There are ratings of trading signals, using which the trader can choose the most suitable provider.

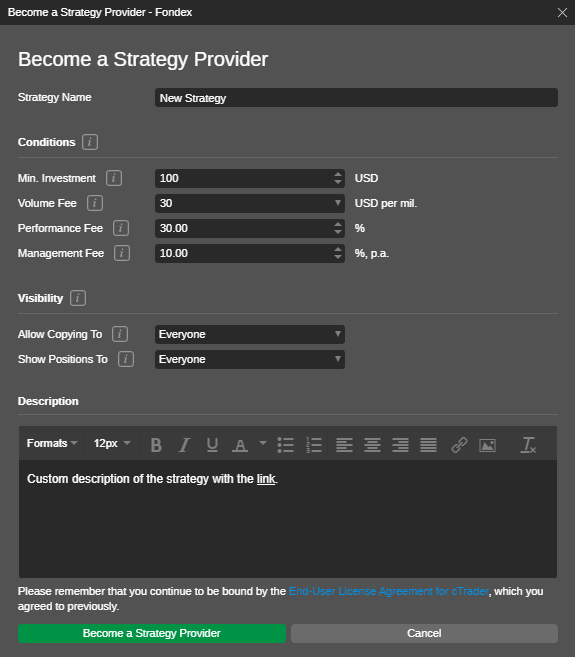

Signals and, in fact, transactions to buy and sell assets describe a particular trading strategy. It can be either conservative or on the contrary — aggressive. The first promises greater reliability with less profit, the second, on the contrary, is focused on maximum profit at high risk. The signal you choose must match the trading strategy you are pursuing.

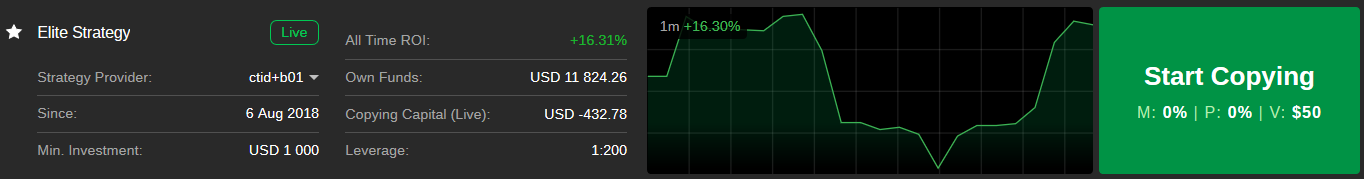

Another important factor is the trading history of the signal provider, it shows how stable his trading strategy is and whether following it leads to a positive result.

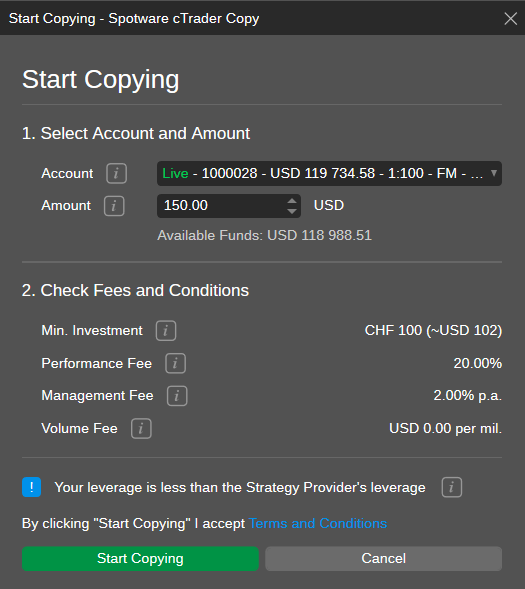

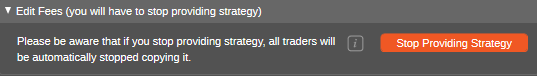

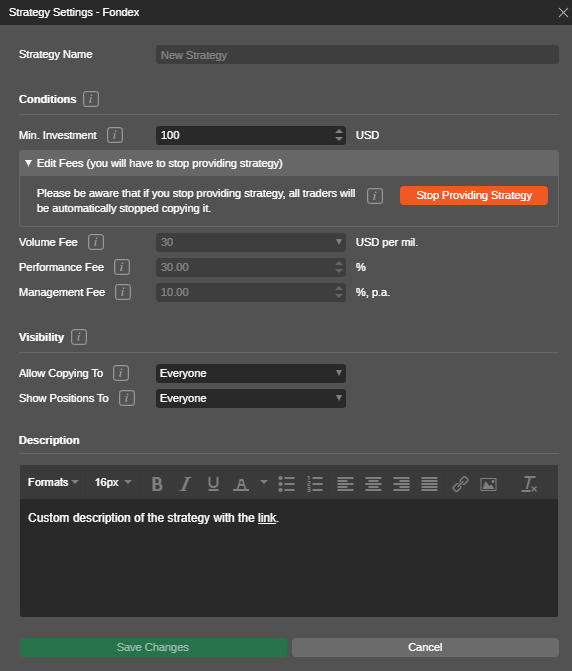

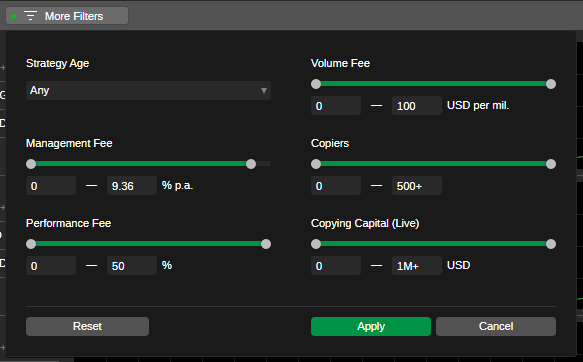

Trading signals may be free or the provider may charge a fee. There is no need to wait for a miracle from free trading signals as a good product cannot be free. However, a high subscription price for signals cannot be a guarantee of quality either. It is necessary to look at his trading history, and be extremely cautious in its absence — an expensive strategy can turn out to be unprofitable.